A Doomer Guide to 2026

Invest like it’s Medieval Times.

Welcome to the second edition of One Man’s Opinion, where I, i-D’s graphic designer, share some of my takes. In honor of a new year, I’ve got some suggestions for how to future-proof your life.

At the tail end of 2025, following a crash in the price of Bitcoin, we experienced—for the first time in about 15 years—a massive spike in the price of silver. This is kind of a rough omen for 2026. In 2011, the last time silver prices surged, was a time of grave uncertainty; the Mayan calendar had prophesied the doomsday event for the following year and the Occupy Wall Street movement had begun. People didn’t trust institutions, which made it reasonable for one to hoard a precious metal as opposed to a federally backed currency—it was a financial rebellion propelled by a fraying relationship between the people and the state. This seems to apply to the current day ten fold, evidently.

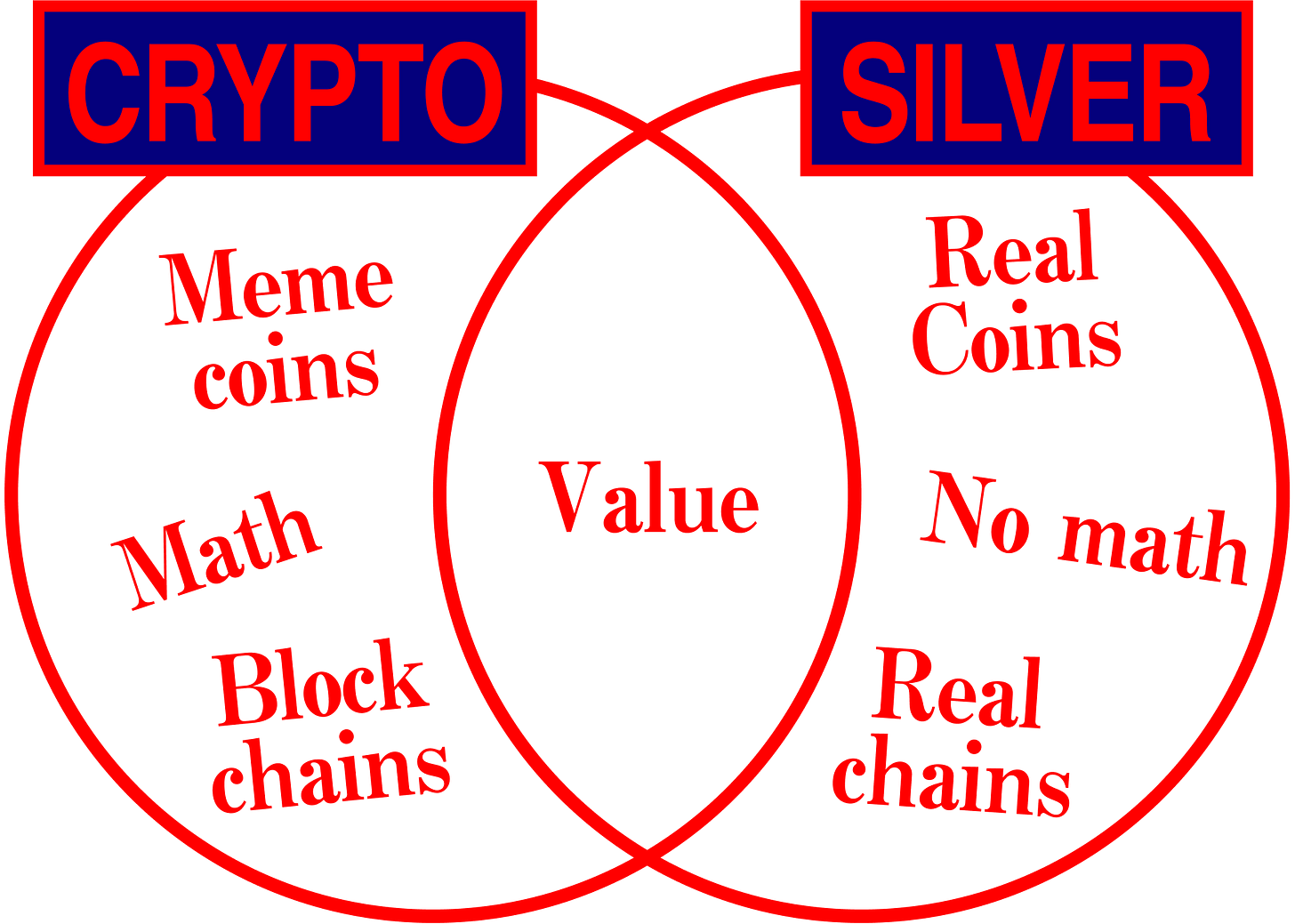

2011 was also kind of when Bitcoin started to catch wind, a digital asset that piggy-backed off of silver’s assertion that an alternate, non-federally-dependent currency is a better investment than something like the US dollar. At the time, Bitcoin was a pretty fringe, largely experimental currency which only had practical roots in weird, otherwise illegal transactions and darkweb markets. Over the course of the next decade it became more mainstream, but still remained wildly volatile. Unlike silver, investment in a technology-based movement like cryptocurrency requires a sharp understanding of all of this alien stuff: blockchain, web3, non-fungibles (and fungibles for that matter).

I first bought Bitcoin as a sophomore in high school in 2016, when I bought 0.13 BTC at around $600 per bitcoin. I told others in my class to buy it, too. Over the course of the next ten years, I repeatedly bought, held, sold, and rebought Bitcoin, sometimes buying low and selling high and sometimes buying high and selling low. I would estimate that I broke even on Bitcoin over the years of 2016 – 2024. My brother told me that, in 2011 – 13, his friends had been spending hundreds of Bitcoins (what would now be tens of millions of dollars) on illegal, online drug marketplaces like Silkroad. Over the course of my ten years investing in bitcoin, I had never used it to actually buy anything, ever.

The spike in silver and the accompanying drop in crypto in the past couple of weeks might be the most doomer start to a year in a while. It means that—maybe because of incessant political collusion, impending war on a global scale, among other things—not only do we distrust institutions more than ever, we also don’t trust and/or understand the digital revolution that was promised to liberate us. So, until we are rescued by this decentralized utopia, it seems we have no choice but to hunker down in caves with all of our silver, similar to how we did in medieval times. Which brings me to—

Don’t be in denial of new hardware. One needs the aptitude to embrace new things like new cameras and new cellphones and new laptops because these new things usually function better than their old counterparts. Mostly, this just means prioritizing utility, which means using AirPods or other bluetooth headphones instead of wired headphones. It means abandoning all forms of style that are dependent on nostalgia or reference. I think, in order to crawl out of our dark, silver-ridden caves, it’s a good exercise to not be tempted by retro-ness, which is a shiny gem that will just lead you further into the depths of the cave. One must resist the “beautiful” past and start walking towards our “ugly” future.

Be skeptical of new software. Yes, you should of course be wary of the media apocalypse that is AI (which has gotten terrifyingly good at replicating iPhone-quality content), but you should also be equally as cautious of niche, “community-based” technologies. For example, I think it’s important that, as of now, we abandon (or at least actively distrust) all web3 platforms. It’s a near certainty that any sort of website that requires the exchange of crypto and has a mainstream user base is somehow taking advantage of our collective crypto-illiteracy. I’ve realized that these sites have a tendency to infiltrate artist-centered communities first, probably because we’re the most gullible, the most spiteful, and also have the least amount of money. They know we will be easily seduced by the prospect of direct-to-consumer sales, exposure, and independence. Don’t be persuaded by taste or hipness. A good general rule of thumb is, if you don’t understand it, don’t use it.

Figure out how to make survival-ware like pans, shoes, and chairs yourself using readily accessible material.

Learn from early internet artists on how to misuse new technologies so that everyone can be more comfortable with alternative, tech-based futures.

Start to whittle down your wardrobe to 3-5 outfits that you wear seasonally. This will be good practice in essentializing your stylistic output, which should remain expressive but also frugal.

Don’t participate in open call submissions for grants that are in search of “The New Aesthetic.” Many people, oftentimes people in places of power or wealth, may try to get you to participate in their creative experiments. It’s important that you ignore these offers. This is because (a) they probably don’t have any good ideas (what does “The New Aesthetic” even mean) and (b) these ideas, if implemented, are often just to make them more money, not to make the world a better place.

Learn how to prepare a wide range of foods with dehydration techniques like smoking in order to make jerky and other preserved consumables.

Hoard Metro Cards, which will go up in value, steadily, for the next 50 to 100 years. This applies to other physical collectibles once used to store money, like certain gift cards.

Don’t go to art school to major in art. Instead, major in a lucrative profession like architecture or industrial design and learn how to make art indirectly from your peers through sheer proximity. Then, upon graduating, leverage your relative financial freedom to cheaply employ these art friends to fabricate things en masse for your newfound art practice.

this post is great because i can't tell if it's being sarcastic or not

The hardware/software split is kinda genius actually. Embracing new hardware while distrusting new software captures the exact vibe of trying to navigate tech right now when every platform wants to tokenize everyhing. I've been burned by enough "community-first" web3 projects that promised direct creator monetization but turned out to be just another layer of rent extraction with extra steps and worse UX.